Feature

Bankify takes the social leap for banking

This fresh fintech startup wants to bring change to the boring aftermaths of shared Friday dinners. Bankify’s idea sprang from the endless chats about ‘who bought what’ and ‘who owes whom’ and became a mission to make everyday finance fun.

As new regulations widen the customer’s choice beyond traditional finance actors, a simple swipe has become all it takes to pay off your debts. However, when sums start adding up during, say, a group trip to the summer cabin, the task to divide costs becomes less swipable.

At least according to Bankify co-founders Antti Tarakkamäki and Tero Lappalainen, who, based on the continuous discussions about money in their group chats, realised there is room for a new type of social app. Their idea was not to compete with already available mobile payment innovations, but to cooperate with them by adding a new dimension designed especially to make the management of shared expenses easy.

“Finance is often seen as challenging, boring, complicated – everything else than fun – so our motto is to change that,” Tarakkamäki explains. “We want to highlight that anyone can be a banker in their own community and that finance management can be a social experience.”

Finance management-turned social game

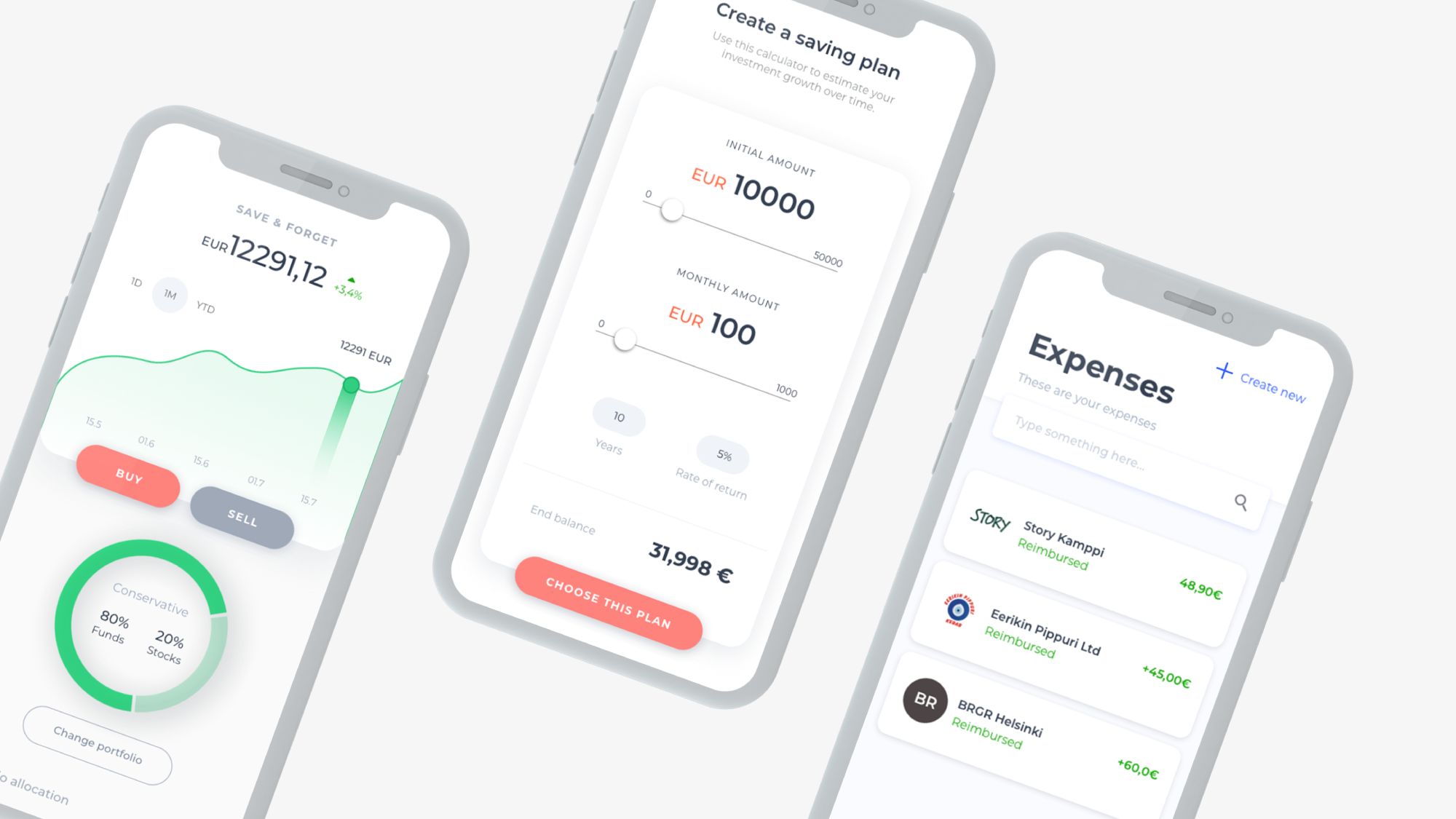

Bankify’s innovation lies in combining mathematics and social media in a way that takes the group chat to the next level. The ‘banker’, who is responsible for the costs, only needs to add the expenses to the app, which then shares the costs and takes care of reminding the participants.

“Or then you can choose not to pay off the debts immediately and become the banker of the next event instead, and in that way balance the costs,” Tarakkamäki continues.

Based on last summer’s soft launch on both Android and iOS in several countries, these functions are especially appreciated among friends or organisations that have a continuous flow of social events. As a part of the Hanken Business Lab incubator, the company has accessed this user group via the university’s students that usually have a need for shared finances. Thus, it decided to invite the students to spread the message to their communities, and at the same time get hands-on experience in the startup business.

“Most of the universities invited to the ambassador programme have already signed up and now we are about to take the concept abroad,” says Tarakkamäki.

Micro crowdfunding for personal projects

While the feedback proves that the company is on the right track, Tarakkamäki emphasises that the app is currently too simple to achieve the global success they are aiming for. However, with the fresh insight gained from the Accenture Accelerator last autumn, where the company participated in the Nordea track, new possibilities were found in younger users’ needs.

Thanks to a major seed investment from Odysseus Investments Fund, as well as Business Finland funding, the app is now moving towards the next stage.

“Version 2.0 will be ready by March, when it will be commercially launched first in Finland and Ireland,” says Tarakkamäki. “The plan is to then continue to new markets by the summer.”

In this new version, the focus has been turned to the millennials that might not have the money needed to become the banker of an event. To solve this, a micro crowdfunding feature will be added that allows the user to gather the money before the event and also use the app to manage personal projects.

“If you are in need of more systematic finance planning, for example when saving for a driving license, you can start a project on the app and invite relatives to be the sponsors,” Tarakkamäki explains.

Strictly user-focused

Bankify’s user-centric business model has heightened the company’s attractiveness among traditional finance actors. Currently the company is investigating how the new functions can be used to create added value to customers by linking them to more traditional banking services.

“This kind of co-operation could add an educative angle about bank services, as today’s youngsters usually don’t go to the offices and the service needs to be available through digital channels,” Tarakkamäki emphasises.

The startup has also made a conscious decision to use external partners instead of becoming a regulated finance organisation, which, for example, means that the app is not a payment method in itself. Instead, it can be linked to any already available service, making it easy to adapt to new markets. Bankify’s sights are thus firmly set on international expansion.

“Our global vision is that the banker app will help millions of young adults to improve their everyday finance management in an economically sustainable way,” Tarakkamäki summarises.

Good News from Finland is published by Finnfacts, which is part of Business Finland.